Computing the Option Greeks using Pathway and Databento

Luca Metehau

Luca MetehauOption Greeks with Databento and Pathway

Introduction

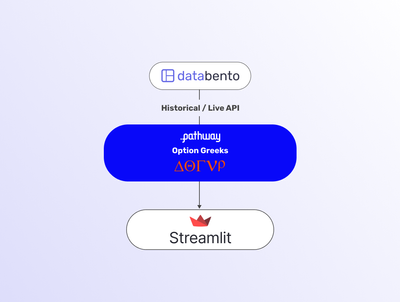

Option Greeks are essential tools in financial risk management, measuring an option's price sensitivity. In this article, you'll learn to compute Option Greeks using the Black/Black 76 model, a variant of the more known Black-Scholes model, and Databento's real-time and historical market data APIs. You'll compute the key Option Greeks, Delta, Gamma, Theta, Vega, and Rho, updating these values in real-time with Pathway to match the real-time data provided by Databento.

You can find the sources of the entire project in our public repository.

About Pathway

Pathway is a Python data processing framework for analytics and AI pipelines over data streams. It’s the ideal solution for real-time processing use cases like computing the Option Greeks. Pathway comes with an easy-to-use Python API, syntax that is simple and intuitive, and you can use the same code for both batch and streaming processing. Pathway is powered by a scalable Rust engine based on Differential Dataflow and performing incremental computation.

About Databento

Databento is a market data provider aiming at making access to institutional-grade financial data simpler and faster. By providing the data directly without third-parties, Databento provides market data APIs with low latency and without data loss. Their simple Python APIs are an ideal data source to perform real-time financial analysis using Pathway. Don't hesitate to browse Databento catalog to see all the available data.

Option Greeks

Options are financial derivatives that give the holder the right, but not the obligation, to buy or sell an underlying asset at a specified price within a certain period. On the other hand, futures are contracts that obligate the parties involved to buy or sell an asset at a predetermined price on a specified future date. Options are commonly used in various financial strategies, including hedging and speculation.

In this tutorial, you are going to manipulate options on futures.

There are two kind of options: (1) call options and (2) put options. A call option gives the holder the right, but not the obligation, to buy the underlying asset at a specified price (the strike price) before or at the option's expiration date. On the other hand, a put option gives the holder the right, but not the obligation, to sell the underlying asset at the strike price before or at the expiration date.

In options trading, Option Greeks are metrics used to assess the sensitivity of option prices and provide detailed, quantifiable measures of various risk factors. Using Option Greeks, traders and risk managers make more informed, strategic decisions, enhancing their ability to manage risk and optimize returns.

Each Option Greek measures the sensisibility of option prices to different factors:

- Delta () measures the change in an option's price relative to the change in the underlying asset's price. For a call option, Delta is positive, ranging from 0 to 1. This is because as the underlying asset's price increases, the call option becomes more valuable. For a put option, Delta is negative, ranging from -1 to 0. This is because as the underlying asset's price decreases, the put option becomes more valuable.

- Gamma () indicates the rate of change of Delta with respect to changes in the price of the underlying asset for both calls and puts. A high Gamma indicates that Delta can change rapidly. Monitoring Gamma helps in understanding how stable an option's Delta is.

- Theta () represents the time decay of an option. For call options, Theta is usually negative, indicating the option loses value as time passes, given all else remains constant. For put options, Theta is also negative, but the rate at which the value decays can differ because the time decay effect can be more pronounced in different market conditions and volatilities.

- Vega () measures sensitivity to volatility for both calls and puts. Higher volatility increases the value of both calls and puts, but the degree can vary depending on whether it's a call or a put and their respective positions relative to the strike price.

- Rho () indicates sensitivity to interest rate changes. For call options, Rho is positive, meaning the value of a call option increases as interest rates rise. For put options, Rho is negative, meaning the value of a put option decreases as interest rates rise.

These metrics help traders and risk managers understand and hedge the risks associated with options positions. You can learn more about Option Greeks here .

Generic formulas

First, let's introduce some notations. Let's define to help us define the Greeks. Here,

- is the futures price, the agreed-upon price in a futures contract between 2 parties, of an asset, at a specified time in the future

- is the strike price, the price at which one can sell/buy that option,

- is the time to expiration in years,

- is the risk-free interest rate, the theoretical rate of return of an investment with zero risk,

- is the volatility, the variation of prices over some time interval, also known as the standard deviation of logarithmic returns,

- is the standard normal cumulative distribution function,

- is the standard normal probability density function.

The Option Greeks are defined using and . Formula changes depending on whether the option is a call or a put.

Delta ()

- Call option:

- Put option:

Gamma ()

- For both call and put options:

Theta ()

- For call option:

- For put option

Vega ()

- For both call and put options:

Rho ()

- For call option:

- For put option:

Our article is inspired by this article from Databento, which computes the volatility for options for the front-month contract. You can check out their page for more insight.

Let's get started!

Getting started

Get your API key

First, you need financial data. Stock market data is usually public and can be accessed using APIs. Databento provides simple and fast Python APIs to access market data. You can signup and get free credits. You will obtain an API key with your account: save it, you will need it to access the data.

Install the required packages

To continue, make sure to install all the needed packages.

!pip install pathway databento pandas scipy numpy python-dotenv

Let's start by importing Pathway and Databento:

import databento as db

import pathway as pw

Load the API keys using an .env file

You need to use the API key to access Databento's data. You can create an .env file and set an environment variable or paste the API key directly into the code.

To use the .env file, you first need to create the file, and then copy the key directly in the file:

API_KEY = "********"

Then, you need to use the os package to load the variable:

import os

from dotenv import load_dotenv

load_dotenv()

API_KEY = os.environ.get("API_KEY")

client = db.Historical(API_KEY)

Getting the data

Let's start with static data and switch to streaming once everything is ready. Both Databento and Pathway make switching to streaming very easy.

Data

Let's focus on E-mini S&P 500 futures contracts whose associated symbol is ES.

The data is from the Globex exchange platform of the CME Group.

Notation

Options are represented by a specific formatting: root symbol + month + year then type + strike price.

Let's take ESM4 C2950 as an example:

- Its root symbol is

ES, it is a E-mini S&P 500 future contract. - M4 refers to the expiration month and year of the contract: it expires in June 2024.

- C means that it is a call option. P is used for puts.

- 2950 is the strike price of the option. It is the prices at which the holder can buy the ESM4 future contract.

ESM4 is called the underlying asset of the of the option, it is the E-mini S&P 500 futures contract that expires in June 2024.

Definitions and orders

The data is separated into two datasets: the definitions and the orders.

Definitions provides reference information about each instrument. For options, you are going to use those:

- The symbol of option.

- The identifier of the option.

- The underlying future.

- The type of option.

- The expiration time of the option.

- The strike price of the option.

- The time of reception of the data.

This data is static by nature and do not change over time.

In addition to the definitions, you also need the state of the market. You will use the order book. For options, you will need:

- The symbol of the option.

- The bid price.

- The ask price.

You won't need the times of the order as only the orders from the requested time slot will be received. The book order data is dynamic by nature as new orders arrive over time. However, this article will focus on querying historical data: past orders from a given time period. This data is static as it is data from a given time period: all the orders of this time period are known and included in the data.

Reading the definitions

The CME Globex data can be found in the GLBX.MDP3 dataset and the definition schema. This provides us with useful information about our options, such as the option type or expiration time of the future.

db_dataset = "GLBX.MDP3" # CME Globex MDP 3.0

db_def_schema = "definition" # this provides us the reference information of each instrument

db_def_symbols = ["ES.OPT"] # all options whose root symbol is ES

For historical data, the start time and duration are also needed:

import pandas as pd

start_time = pd.Timestamp("2024-04-04T17:00:00", tz="Us/Central")

data_duration = pd.Timedelta(days=1)

Let's define a custom Pathway connector, to read the data directly from Databento's API. First, you need to declare the schema of the data:

class DefinitionInputSchema(pw.Schema):

ts_recv: int # time in ns when the data was received

raw_symbol: str # symbol of option

expiration: int # expiration time of the option

instrument_class: str # type of option

strike_price: float # see below for what it means

underlying: str # symbol of the first underlying instrument

instrument_id: int # An identifier of the option

Now, you need to define a ConnectorSubject that will define how the data is read and ingested by Pathway.

The market data is accessed in the ConnectorSubject using Databento's time series:

class DefinitionSubject(pw.io.python.ConnectorSubject):

def run(self):

# First, get Databento's data:

data = client.timeseries.get_range(

dataset=db_dataset,

schema=db_def_schema,

symbols=db_def_symbols,

stype_in=db.SType.PARENT,

start=start_time,

end=start_time + data_duration,

)

# Now, ingest the data into Pathway:

for row in data:

# Get the attributes you are interested in

ts_recv = getattr(row, "ts_recv")

raw_symbol = getattr(row, "raw_symbol")

expiration = getattr(row, "expiration")

instrument_class = getattr(row, "instrument_class")

strike_price = getattr(row, "strike_price") / 1e9

underlying = getattr(row, "underlying")

instrument_id = getattr(row, "instrument_id")

# Transmit the data

self.next(

ts_recv=ts_recv,

raw_symbol=raw_symbol,

expiration=expiration,

instrument_class=instrument_class,

strike_price=strike_price,

underlying=underlying,

instrument_id=instrument_id,

)

You can read more about how to access Databento data in Databento's Documentation.

Now you can create the table using the Python connector:

table_es = pw.io.python.read(DefinitionSubject(), schema=DefinitionInputSchema)

| ts_recv | raw_symbol | expiration | instrument_class | strike_price | underlying | instrument_id

^NQ4SN5H... | 1712268100558405731 | UD:1V: SG 2766914 | 1712354340000000000 | T | 9223372036.854776 | | 2766914

^TKNWB16... | 1712268121809444020 | UD:1V: GN 2766927 | 1712354340000000000 | T | 9223372036.854776 | | 2766927

^QPDB24M... | 1712269634334772214 | UD:1V: 12 2767163 | 1712354340000000000 | T | 9223372036.854776 | | 2767163

^5HSNPF6... | 1712269897918754155 | UD:1V: VT 2767198 | 1712354340000000000 | T | 9223372036.854776 | | 2767198

^3EH930P... | 1712270087811250835 | UD:1V: GT 2767215 | 1712354340000000000 | T | 9223372036.854776 | | 2767215

Extracting relevant options data

Currently, your table contain all the options.

You need to keep only the one you are interested in.

Among all the futures corresponding to the associated future ES, let's focus on ESM4.

In practice you may be interested in the front-month symbol, the one that has the closest expiration date.

front_month_symbol = 'ESM4'

Let's filter the data to only keep the options associated with ESM4 futures.

To only compute the Greeks for the correct options, let's filter out all those whose underlying instrument is different from ESM4:

table_esm4 = table_es.filter(pw.this.underlying==front_month_symbol)

| ts_recv | raw_symbol | expiration | instrument_class | strike_price | underlying | instrument_id

^9JKNAD4... | 1712275200000000000 | ESM4 C0055 | 1718976600000000000 | C | 55.0 | ESM4 | 42409251

^4BKX67J... | 1712275200000000000 | ESM4 C0100 | 1718976600000000000 | C | 100.0 | ESM4 | 42406524

^SB2J9YB... | 1712275200000000000 | ESM4 C0200 | 1718976600000000000 | C | 200.0 | ESM4 | 42439016

^CVV6ENZ... | 1712275200000000000 | ESM4 C0300 | 1718976600000000000 | C | 300.0 | ESM4 | 42439018

^HRK3X6X... | 1712275200000000000 | ESM4 C0700 | 1718976600000000000 | C | 700.0 | ESM4 | 129750

As a safeguard, let's also filter on the instrument_class to make sure the value is either C (CALL) or P (PUT):

table_esm4 = table_esm4.filter((pw.this.instrument_class == 'C') | (pw.this.instrument_class == 'P'))

| ts_recv | raw_symbol | expiration | instrument_class | strike_price | underlying | instrument_id

^9JKNAD4... | 1712275200000000000 | ESM4 C0055 | 1718976600000000000 | C | 55.0 | ESM4 | 42409251

^4BKX67J... | 1712275200000000000 | ESM4 C0100 | 1718976600000000000 | C | 100.0 | ESM4 | 42406524

^SB2J9YB... | 1712275200000000000 | ESM4 C0200 | 1718976600000000000 | C | 200.0 | ESM4 | 42439016

^CVV6ENZ... | 1712275200000000000 | ESM4 C0300 | 1718976600000000000 | C | 300.0 | ESM4 | 42439018

^HRK3X6X... | 1712275200000000000 | ESM4 C0700 | 1718976600000000000 | C | 700.0 | ESM4 | 129750

Option orders

Now that you have the options, you need to find the associated orders. The prices, used to compute the volatility, are obtained by averaging all the bids and ask prices. Hence, mid-price is the correct term.

This data will be obtained from the mbp-1 schema (Market by price), which provides every event that updates the top price.

To limit data usage, you can query only the symbols present in your data:

table_symbols = table_esm4.reduce(symbol_tuple = pw.reducers.tuple(pw.this.raw_symbol))

symbol_list = [front_month_symbol] + list(pw.debug.table_to_pandas(table_symbols)['symbol_tuple'][0])

As an example, let's only query over a 2 minutes time interval, to limit the number of data to extract and process. Similarly to the definition schema, you will use a custom connector to read the data from Databento:

db_price_schema = "mbp-1"

class MBP1InputSchema(pw.Schema):

raw_symbol: str # the symbol of the option

bid_px: float # the bid price

ask_px: float # the ask price

# Only 2 minutes

query_data_duration = pd.Timedelta(minutes=2)

class MBP1Subject(pw.io.python.ConnectorSubject):

def run(self):

data = client.timeseries.get_range(

dataset=db_dataset,

schema=db_price_schema,

start=start_time,

end=start_time + query_data_duration,

symbols=symbol_list

)

# Databento's instrument map, which will help us get the symbols from the row data

instrument_map = db.common.symbology.InstrumentMap()

instrument_map.insert_metadata(data.metadata)

for row in data:

symbol = instrument_map.resolve(row.instrument_id, row.pretty_ts_recv.date())

levels = getattr(row, "levels")

# INT64_MAX is the mark for unknown bid/ask prices

if levels[0].bid_px > (1 << 63) - 10 or levels[0].ask_px > (1 << 63) - 10:

continue

# Prices unit is actually 1e-9

bid_px = levels[0].bid_px / 1e9

ask_px = levels[0].ask_px / 1e9

self.next(

raw_symbol=symbol,

bid_px=bid_px,

ask_px=ask_px,

)

table_mbp1 = pw.io.python.read(MBP1Subject(), schema=MBP1InputSchema)

| raw_symbol | bid_px | ask_px

^Z4T8WTR... | ESM4 | 5199.75 | 5200.0

^R8ZACFQ... | ESM4 | 5199.75 | 5200.0

^VM93KP5... | ESM4 | 5199.75 | 5200.0

^PX3Z53V... | ESM4 | 5199.75 | 5200.0

^3A5E19T... | ESM4 | 5199.75 | 5200.0

To compute the average prices for all bids, you can use a simple groupby/reduce:

table_mbp1 = table_mbp1.groupby(pw.this.raw_symbol).reduce(

raw_symbol=pw.this.raw_symbol,

option_midprice=(pw.reducers.avg(pw.this.bid_px) + pw.reducers.avg(pw.this.ask_px)) / 2,

)

| raw_symbol | option_midprice

^QT4BK1X... | ESM4 | 5203.894756928135

^6ZHHRC0... | ESM4 C3950 | 1255.875

^W641MZJ... | ESM4 C4000 | 1206.25

^WGH73K1... | ESM4 C4050 | 1156.75

^HWYWY52... | ESM4 C4100 | 1107.25

Now, you want to add the data from the table_esm4 to this table_mbp1.

To do so, you need to join the two table on the raw_symbol values:

table_prices = table_esm4.join(

table_mbp1,

pw.left.raw_symbol == pw.right.raw_symbol

).select(

*pw.left, # Adding all the columns from table_esm4

option_midprice=pw.right.option_midprice,

)

| ts_recv | raw_symbol | expiration | instrument_class | strike_price | underlying | instrument_id | option_midprice

^6ZHYYVZ... | 1712275200000000000 | ESM4 C3950 | 1718976600000000000 | C | 3950.0 | ESM4 | 4162742 | 1255.875

^W64CERT... | 1712275200000000000 | ESM4 C4000 | 1718976600000000000 | C | 4000.0 | ESM4 | 574893 | 1206.25

^WGHCM9D... | 1712275200000000000 | ESM4 C4050 | 1718976600000000000 | C | 4050.0 | ESM4 | 4162333 | 1156.75

^HWYHF5C... | 1712275200000000000 | ESM4 C4100 | 1718976600000000000 | C | 4100.0 | ESM4 | 655090 | 1107.25

^GGRY3PT... | 1712275200000000000 | ESM4 C4150 | 1718976600000000000 | C | 4150.0 | ESM4 | 4162743 | 1058.0

Computing the Option Greeks

Now that the data is ready, you can compute the Option Greeks. To do so, you need several values, as you have seen in the Generic Formulas section. Recall that you need:

- , the futures price

- , the strike price

- , the time to expiration

- , the risk-free interest rate

- , the volatility.

Risk-free interest rate

This is a bit more complicated, as it is usually determined by the market and is taken from government securities considered free of default risk. This can be considered more of an input parameter given by the user.

Let's use as the value for this interest rate, based on government available data.

interest_rate = 0.043

Futures price

In the Black/Black 76 Model, the Option Greeks are the options of the front-month contract, this value will be fixed per each front-month contract.

In this case, it will be the stock price/last price of the ESM4 option. You can access rows by value using ix_ref:

table_prices = table_prices.with_columns(

future_price=table_mbp1.ix_ref(front_month_symbol).option_midprice

)

| ts_recv | raw_symbol | expiration | instrument_class | strike_price | underlying | instrument_id | option_midprice | future_price

^6ZHYYVZ... | 1712275200000000000 | ESM4 C3950 | 1718976600000000000 | C | 3950.0 | ESM4 | 4162742 | 1255.875 | 5203.894756928135

^W64CERT... | 1712275200000000000 | ESM4 C4000 | 1718976600000000000 | C | 4000.0 | ESM4 | 574893 | 1206.25 | 5203.894756928135

^WGHCM9D... | 1712275200000000000 | ESM4 C4050 | 1718976600000000000 | C | 4050.0 | ESM4 | 4162333 | 1156.75 | 5203.894756928135

^HWYHF5C... | 1712275200000000000 | ESM4 C4100 | 1718976600000000000 | C | 4100.0 | ESM4 | 655090 | 1107.25 | 5203.894756928135

^GGRY3PT... | 1712275200000000000 | ESM4 C4150 | 1718976600000000000 | C | 4150.0 | ESM4 | 4162743 | 1058.0 | 5203.894756928135

Time to expiration

Using the expiration column, you can compute the time to expiration which is used in our formulas. Because of how the formulas are defined, it is expressed in years.

Be careful, the unit of expiration is nanoseconds.

# Compute the time to expiration, has to be in years

@pw.udf

def compute_time_to_expiration(expiration_time: int) -> float:

return (expiration_time - int(start_time.timestamp() * 1e9)) / (1e9 * 86400 * 365)

table_texp = table_prices.with_columns(

time_to_expiration=compute_time_to_expiration(pw.this.expiration)

)

| ts_recv | raw_symbol | expiration | instrument_class | strike_price | underlying | instrument_id | option_midprice | future_price | time_to_expiration

^6ZHYYVZ... | 1712275200000000000 | ESM4 C3950 | 1718976600000000000 | C | 3950.0 | ESM4 | 4162742 | 1255.875 | 5203.894756928135 | 0.2127283105022831

^W64CERT... | 1712275200000000000 | ESM4 C4000 | 1718976600000000000 | C | 4000.0 | ESM4 | 574893 | 1206.25 | 5203.894756928135 | 0.2127283105022831

^WGHCM9D... | 1712275200000000000 | ESM4 C4050 | 1718976600000000000 | C | 4050.0 | ESM4 | 4162333 | 1156.75 | 5203.894756928135 | 0.2127283105022831

^HWYHF5C... | 1712275200000000000 | ESM4 C4100 | 1718976600000000000 | C | 4100.0 | ESM4 | 655090 | 1107.25 | 5203.894756928135 | 0.2127283105022831

^GGRY3PT... | 1712275200000000000 | ESM4 C4150 | 1718976600000000000 | C | 4150.0 | ESM4 | 4162743 | 1058.0 | 5203.894756928135 | 0.2127283105022831

Implied Volatility

The volatility represents the market's expectation of the future volatility of the underlying asset over the life of the option. Unlike historical volatility, which measures past price fluctuations, implied volatility is derived from the market price of the option itself.

Using the Black Model, you can infer volatility using known data. The option price will be estimated as being the average of the prices associated to that option symbol. You need to compute (the volatility) so that the price calculated in the Black Model is the same as the estimated option price. It comes down to finding the root of a polynomial, which will be done using scipy.

Computing the volatility

What follows next is just the previous formulas being translated into Python.

First, you need to define the function to compute the option price in the Black Model, having computed the volatility, .

import math

def compute_price(

F: float,

K: float,

T: float,

sigma: float,

r: float=interest_rate,

is_call: bool=True

) -> float:

d1 = (math.log(F / K) + (sigma**2 / 2) * T) / (sigma * math.sqrt(T))

d2 = d1 - sigma * math.sqrt(T)

sign = 2 * int(is_call) - 1

return math.exp(-r * T) * sign * (norm.cdf(sign * d1) * F - norm.cdf(sign * d2) * K)

Now, solve the equation by finding the roots of

using scipy's root finding function. To mark the non-convergence/non-existence of a root, return .

import scipy

from scipy.stats import norm

@pw.udf

def compute_volatility(

F: float,

K: float,

T: float,

_is_call: bool,

option_midprice: float

) -> float | None:

result = scipy.optimize.root_scalar(

lambda sigma: option_midprice - compute_price(

F=F,

K=K,

T=T,

sigma=sigma,

is_call=_is_call

),

x0=0.0001,x1=0.8

)

return result.root if result.converged else None

Computing ,

Now, let's compute the , defined as before. Let's define those functions as Pathway user-defined function using the pw.udf decorator. Another alternative would be to declare the functions as simple Python functions and apply them to the columns using pw.apply.

@pw.udf

def compute_d1(

F: float,

K: float,

T: float,

sigma: float,

r: float = interest_rate,

) -> float:

return (math.log(F / K) + (sigma**2 / 2) * T) / (sigma * math.sqrt(T))

@pw.udf

def compute_d2(

F: float,

K: float,

T: float,

sigma: float,

r: float = interest_rate

) -> float:

return (math.log(F / K) + (sigma**2 / 2) * T) / (sigma * math.sqrt(T)) - sigma * math.sqrt(T)

Option Greeks functions

You can now define the functions to compute the Option Greeks using , , , , , , and :

@pw.udf

def compute_delta(F: float, K: float, T: float, sigma: float, d1: float, d2: float, is_call: bool, r: float = interest_rate) -> float:

return math.exp(-r * T) * norm.cdf(d1) if is_call \

else -math.exp(-r * T) * norm.cdf(-d1)

@pw.udf

def compute_gamma(F: float, K: float, T: float, sigma: float, d1: float, d2: float, is_call: bool, r: float = interest_rate) -> float:

return math.exp(-r * T) * norm.pdf(d1) / (F * sigma * math.sqrt(T))

@pw.udf

def compute_theta(F: float, K: float, T: float, sigma: float, d1: float, d2: float, is_call: bool, r: float = interest_rate) -> float:

return (-F * sigma * norm.pdf(d1) / (2 * math.sqrt(T)) - r * K * math.exp(-r * T) * norm.cdf(d2) + r * F * math.exp(-r * T) * norm.cdf(d1)) / 252 if is_call \

else (-F * sigma * norm.pdf(d1) / (2 * math.sqrt(T)) + r * K * math.exp(-r * T) * norm.cdf(-d2) - r * F * math.exp(-r * T) * norm.cdf(-d1)) / 252# per day

@pw.udf

def compute_vega(F: float, K: float, T: float, sigma: float, d1: float, d2: float, is_call: bool, r: float = interest_rate) -> float:

return F * norm.pdf(d1) * math.sqrt(T) * math.exp(-r * T) / 100

@pw.udf

def compute_rho(F: float, K: float, T: float, sigma: float, d1: float, d2: float, is_call: bool, r: float = interest_rate) -> float:

return -T * math.exp(-r * T) * (F * norm.cdf(d1) - K * norm.cdf(d2)) / 100 if is_call \

else -T * math.exp(-r * T) * (K * norm.cdf(-d2) - F * norm.cdf(-d1)) / 100

Computing the Options Greeks on the data

All you need to do is to use the UDFs you have just defined.

First, let's add a column to determine if the option is a call or a put:

table_texp = table_texp.with_columns(is_call=pw.this.instrument_class == 'C')

Now, you can start computing the Options Greeks. First, let's start with the implied volatility, pre-filtering.

table_volatility_unfiltered = table_texp.with_columns(

volatility=compute_volatility(

pw.this.future_price,

pw.this.strike_price,

pw.this.time_to_expiration,

pw.this.is_call,

pw.this.option_midprice

)

)

Filter out entries were volatility couldn't be computed.

table_sigma = table_volatility_unfiltered.filter(pw.this.volatility.is_not_none())

| ts_recv | raw_symbol | expiration | instrument_class | strike_price | underlying | instrument_id | option_midprice | future_price | time_to_expiration | is_call | volatility

^SEETXE6... | 1712275200000000000 | ESM4 C4575 | 1718976600000000000 | C | 4575.0 | ESM4 | 42428240 | 645.5 | 5203.894756928135 | 0.2127283105022831 | True | 0.2162233311762161

^1G3X41B... | 1712275200000000000 | ESM4 C4600 | 1718976600000000000 | C | 4600.0 | ESM4 | 475865 | 621.825 | 5203.894756928135 | 0.2127283105022831 | True | 0.21209709275524571

^Q3V7DPW... | 1712275200000000000 | ESM4 C4625 | 1718976600000000000 | C | 4625.0 | ESM4 | 42428989 | 598.4921875 | 5203.894756928135 | 0.2127283105022831 | True | 0.20861065805521786

^X8WX1ZA... | 1712275200000000000 | ESM4 C4650 | 1718976600000000000 | C | 4650.0 | ESM4 | 4162744 | 574.8984375 | 5203.894756928135 | 0.2127283105022831 | True | 0.20429512451895476

^K0DSPC7... | 1712275200000000000 | ESM4 C4675 | 1718976600000000000 | C | 4675.0 | ESM4 | 42426723 | 551.625 | 5203.894756928135 | 0.2127283105022831 | True | 0.20050269603979845

Having filtered the volatility table, you can now compute the useful variables .

table_d1d2 = table_sigma.with_columns(

d1=compute_d1(pw.this.future_price, pw.this.strike_price, pw.this.time_to_expiration, pw.this.volatility),

d2=compute_d2(pw.this.future_price, pw.this.strike_price, pw.this.time_to_expiration, pw.this.volatility)

)

| ts_recv | raw_symbol | expiration | instrument_class | strike_price | underlying | instrument_id | option_midprice | future_price | time_to_expiration | is_call | volatility | d1 | d2

^SEETXE6... | 1712275200000000000 | ESM4 C4575 | 1718976600000000000 | C | 4575.0 | ESM4 | 42428240 | 645.5 | 5203.894756928135 | 0.2127283105022831 | True | 0.2162233311762161 | 1.341388776078269 | 1.2416612147215103

^1G3X41B... | 1712275200000000000 | ESM4 C4600 | 1718976600000000000 | C | 4600.0 | ESM4 | 475865 | 621.825 | 5203.894756928135 | 0.2127283105022831 | True | 0.21209709275524571 | 1.3098551501158648 | 1.2120307122243743

^Q3V7DPW... | 1712275200000000000 | ESM4 C4625 | 1718976600000000000 | C | 4625.0 | ESM4 | 42428989 | 598.4921875 | 5203.894756928135 | 0.2127283105022831 | True | 0.20861065805521786 | 1.2737927697937403 | 1.177576362028194

^X8WX1ZA... | 1712275200000000000 | ESM4 C4650 | 1718976600000000000 | C | 4650.0 | ESM4 | 4162744 | 574.8984375 | 5203.894756928135 | 0.2127283105022831 | True | 0.20429512451895476 | 1.2414770192939824 | 1.1472510425942404

^K0DSPC7... | 1712275200000000000 | ESM4 C4675 | 1718976600000000000 | C | 4675.0 | ESM4 | 42426723 | 551.625 | 5203.894756928135 | 0.2127283105022831 | True | 0.20050269603979845 | 1.2052118711951851 | 1.1127350565390985

And finally, you have everything necessary to compute the Option Greeks.

table_greeks = table_d1d2.select(

ts_recv=pw.this.ts_recv,

instrument_id=pw.this.instrument_id, # option identifier

delta=compute_delta(F=pw.this.future_price, K=pw.this.strike_price, T=pw.this.time_to_expiration,

sigma=pw.this.volatility, d1=pw.this.d1, d2=pw.this.d2, is_call=pw.this.is_call),

gamma=compute_gamma(F=pw.this.future_price, K=pw.this.strike_price, T=pw.this.time_to_expiration,

sigma=pw.this.volatility, d1=pw.this.d1, d2=pw.this.d2, is_call=pw.this.is_call),

theta=compute_theta(F=pw.this.future_price, K=pw.this.strike_price, T=pw.this.time_to_expiration,

sigma=pw.this.volatility, d1=pw.this.d1, d2=pw.this.d2, is_call=pw.this.is_call),

vega=compute_vega(F=pw.this.future_price, K=pw.this.strike_price, T=pw.this.time_to_expiration,

sigma=pw.this.volatility, d1=pw.this.d1, d2=pw.this.d2, is_call=pw.this.is_call),

rho=compute_rho(F=pw.this.future_price, K=pw.this.strike_price, T=pw.this.time_to_expiration,

sigma=pw.this.volatility, d1=pw.this.d1, d2=pw.this.d2, is_call=pw.this.is_call),

)

| ts_recv | instrument_id | delta | gamma | theta | vega | rho

^5E27F9C... | 1712275200000000000 | 167568 | -0.36522676487252637 | 0.0010761593568397742 | -1.20578430675957 | 8.968515868438663 | -0.1926159649113528

^1J4SBJJ... | 1712275200000000000 | 171004 | 0.8344597586919202 | 0.0005463957838523174 | -0.9092871240628488 | 5.736160034211216 | -0.9307176420225614

^SD7Y171... | 1712275200000000000 | 173016 | 0.26160685918220006 | 0.0011091334660315651 | -0.8828828811890805 | 7.775192039362197 | -0.09595904533756298

^XHM3GRB... | 1712275200000000000 | 235276 | 0.6252047990195576 | 0.0010716446664050228 | -1.1942779640728063 | 8.97223714773127 | -0.4128950764706649

^P478AH2... | 1712275200000000000 | 239235 | -0.0009342074735111986 | 1.6742179678815765e-06 | -0.056076470450669505 | 0.07586357701342025 | -0.001141369204432041

Output

Now that you have successfully computed the Option Greeks, you can output the results to your favorite system. Pathway supports many different connectors.

As an example, you might want to send the results to a CSV file, using Pathway CSV output connector:

pw.io.csv.write(table_greeks, "./options-greeks.csv")

Now, all you need it to run the computation:

pw.run()

The Options Greeks will be computed and stored in the option-greeks.csv file.

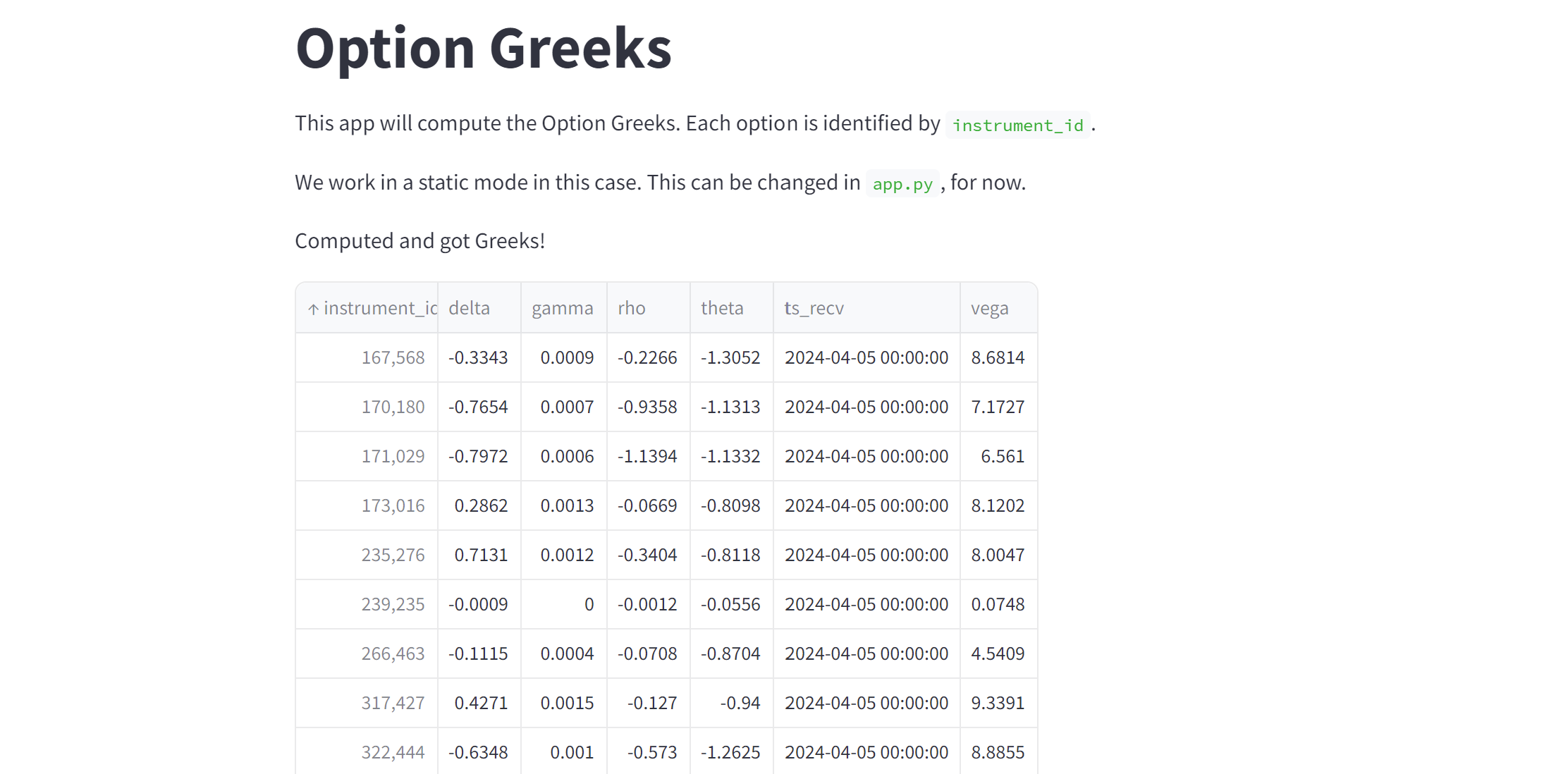

Streamlit User Interface

For a more user-friendly output, you can also output the data to a dashboard to visualize your results. As an example, you can easily set up a dashboard using Streamlit:

You can find the sources to obtain this dashboard in our public GitHub repository.

Going live

Pathway has a unified engine capable of processing both static and streaming data, making it easy to transition from one mode to the other.

You can easily make the book orders dynamic by updating the input connector ConnectorSubject (MBP1Subject) to simulate real-time data streaming by adding a time.sleep() function call after each next call.

This small modification introduces a delay between data points, emulating the arrival of new data over time.

The updated source is available in our public GitHub repository.

In this case, Pathway will update the results every time the input changes, at the reception of new data point from the mbp-1 data for example.

Furthermore, you can use Databento live APIs to obtain the market live data for the book orders and have the Option Greeks updated in real-time as the live data is ingested. This way, you can make full use of the streaming mode.

Conclusions

Congratulations! You now are able to compute the implied volatility and the Option Greeks using Databento to extract the historical market data and Pathway to process it. Pathway is the ideal tool for quantitative projects, allowing you to compute complex financial metrics like Options Greek in real-time. If you are interested, check our example about Bollinger Bands or reach out to us on Discord!

Acknowledgements

We would like to express our gratitude to Databento for their valuable help and support in the creation of this article.

- Luca Metehau

tutorial · engineeringAug 6, 2024Computing the Option Greeks using Pathway and Databento

tutorial · engineeringAug 6, 2024Computing the Option Greeks using Pathway and Databento  Olivier Ruas

Olivier Ruas blog · tutorial · engineering · frameworkFeb 2, 2026Real-Time OCR with PaddleOCR and Pathway

blog · tutorial · engineering · frameworkFeb 2, 2026Real-Time OCR with PaddleOCR and Pathway Saksham Goel

Saksham Goel blog · tutorial · engineeringFeb 5, 2025Real-Time AI Pipeline with DeepSeek, Ollama and Pathway

blog · tutorial · engineeringFeb 5, 2025Real-Time AI Pipeline with DeepSeek, Ollama and Pathway